There has been a huge impact on every sector of the world due to digital transformation trends, new technologies, and strategies.

Even the very technical Financial sector is going through a big change in how it works.

But to make things easier and faster in the financial world, transformation, technologies, and methods have come together to create a new term and process called "Fintech." With the help of AI in fintech and machine learning (AI-ML development), this industry has undergone a major change.

Based on a study by the Economist Intelligence Unit, 54% of Financial Services companies with 5,000 or more workers have started using AI. The study also found that 86% of executives in the financial services industry plan to put more money into AI-related projects by 2025.

When we talk about the role of AI in fintech, banks and other financial companies already know about it. We've all seen examples of artificial intelligence in banking, like the fact that processing checks automatically started in 1950.

What is Artificial Intelligence?

Artificial intelligence (AI) is a broad area of computer science that focuses on making computers smart enough to do things that usually require human intelligence.

AI isn't just happening in the retail market; it's also happening in fields like

- • Heavy industries

- • Air transport

- • Medical Sciences

- • Gaming zone

- • Banks

- • Financial sector

What is FinTech?

The word "fintech" is used to describe new technology that aims to improve and simplify the way financial services are delivered and used. Most of the time, AI is used in the fintech market to help organizations, business owners, and individuals better manage their money.

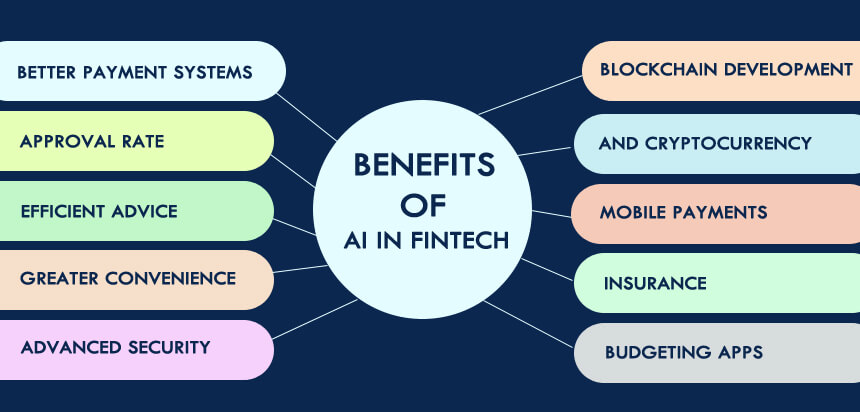

Benefits of AI in Fintech for Consumers

Using AI and machine learning in the financial services business can be helpful in a number of ways. Instead of depending only on human workers, companies that use AI/ML to improve their predictive models can process huge amounts of data, improve their work processes, and cut down on fraud.

- • Better payment systems

- • Approval rate

- • Efficient advice

- • Greater convenience

- • Advanced security

- • More personalized service

- • Lower cost

FinTech app ideas abound for start-ups and well-established companies looking to establish a foothold in the following markets:

- • Blockchain development

- • and Cryptocurrency

- • Crowdfunding Platforms

- • Mobile Payments

- • Insurance

- • Robo-Advising and Stock-Trading Apps

- • Budgeting Apps

- • Fintech Stocks

Challenges Associated with Fintech

Even though technology is changing the future of FinTech, the industry has created a wave of new things and changed many business sectors. It also faces its own set of problems.

AI in fintech is changing the financial system by using technology that can also learn about what customers want and what makes them unhappy. The large amount of information that is studied makes it possible to give customers a more personalized experience.

Those FinTech Challenges are-

1# Credibility

In the future, Fintech will have many economic benefits, but for now, it isn't able to streamline customers' financial lives completely.

2# Discover

It does not follow that other tech giants accept FinTech because you do. When competing with other tech giants and fierce competition, it is challenging to make your product available to a wide audience.

3# Customer Relationships

Having good ties with customers helps the business grow. Like with FinTech, it's important to build good customer ties if you want people to keep using your service or buying your product. With the help of the real-time financial reporting dashboard, businesses are making sure they have better relationships with each other.

Now that we know the basics of both AI and FinTech, it's time to look at how Artificial Intelligence in FinTech is making the FinTech business more productive.

companies don't ask their customers how they feel about their financial services.

Without further ado, let us see how Artificial Intelligence is shaping Fintech in a major way-

Uses Of Artificial Intelligence In the FinTech Industry

1# Accurate Decision-Making

According to the PwC Global Fintech Report, 30% of big financial institutions invest in developing AI applications. This is because AI is becoming more important in financial services. The percentage shows that AI has a lot of promise in the FinTech field.

Thanks to Artificial Intelligence and the Internet of Things in the banking and financial industries, insurance and banking agents will be able to ask computers the right questions instead of asking human experts.

2# Detection of Fraud

Fintech uses AI to detect fraud symptoms and other incidents by learning & analyzing user behavioral patterns based on analytics tools.

The banks can then detect fraud more rapidly and introduce safeguards or set standards to prevent fraud and forgery in the future.

3# Claim Handling Mechanism

In various stages of claim processing, machine learning approaches can be used to build the claim management.

Utilizing AI trends in financial services will enable claims to be processed faster while lowering processing time and improving customer experience.

4# Customer Support

In the form of voice systems, chat bots, and text chats, Artificial Intelligence is capable of delivering human-like customer service and expert advice at lower costs.

5# Virtual Financial Assistants

One of the most popular trends in digital transformation for companies is the use of virtual financial assistants. It becomes easier for users to make financial decisions with the help of these assistants. In order to get recommendations regarding buying and selling bonds and stocks, the decision makers could monitor stock and bond price trends, events, etc.

6# Predictive Analysis

Financial services can benefit from predictive analytics in many ways, including revenue generation, resource optimization, and business strategy.

In addition to improving business operations, it can refine internal processes and help companies surpass their competitors. Furthermore, predictive analytics can be used in finance to calculate credit scores and prevent bad loans in many ways.

7# Risk Management

AI has a lot to offer when it comes to handling financial risk, and it would be a mistake to underestimate it.

Processing lets you handle data in a short amount of time, while cognitive computing helps you manage both organized and unstructured data, which would be hard for a person to do. So, algorithms look at the past of risk and look for early signs of problems that might happen in the future.

Future Of AI In Fintech

1# Stiffening Competition

Competition increases as opportunities expand. In addition to giants like Apple and Google, specialized initiatives like Venmo, and traditional financial institutions, pioneers like PayPal find themselves challenged. Business owners are transferring their focus from the national market to the local and regional markets, where conditions are still favorable.

2# Leveraging Technology

Convenience is the biggest selling point, and a lot of companies have failed to make the customer experience better. Technology has completely changed the way payments are made, from banks to budgeting to loan applications.

Because of this, e-commerce giant Amazon is now focusing on mobile because more and more people use their phones and computers to do their computing. Also, AI in Fintech may have a big impact because people's data can be used to learn a lot about how things work.

3# Right Algorithms

The main goal of fintech is to give small businesses and individuals more power, and the addition of AI technology to fintech is meant to help more people take advantage of its benefits.

This is the end of how AI in FinTech is causing a wave of change, and there are also a lot of AI-based apps for consumers that make things faster, better, and less likely to go wrong. So, if you want to make an app like this for your business, you should talk to the best financial mobile app development company.

How Zestminds Will Help In Developing Fintech Application?

Evolution is a normal part of the process, and we shouldn't think of AI as something that will bring about the end of the world. We are still alive in the middle of a worldwide outbreak because of AI and other related technologies.

As time goes on, its job will become even more important. If you want to ride the AI wave in fintech, an AI development business like Zestminds can help you build fintech applications. The idea you have needs to become a real thing, and to do that, you need the right financial app development company, like ours.

Our AI and machine learning-based development services are the best of the bunch, and we would work to make your idea the next big thing in the fintech field. You need our AI creation services to become the next unicorn. So, if just the idea of this gets you excited, let us tell you that developing fintech applications is the way to go.

Shivam Sharma

About the Author

With over 13 years of experience in software development, I am the Founder, Director, and CTO of Zestminds, an IT agency specializing in custom software solutions, AI innovation, and digital transformation. I lead a team of skilled engineers, helping businesses streamline processes, optimize performance, and achieve growth through scalable web and mobile applications, AI integration, and automation.

Stay Ahead with Expert Insights & Trends

Explore industry trends, expert analysis, and actionable strategies to drive success in AI, software development, and digital transformation.